Table of Contents

BCBS 239 Compliance Through Practical Data Governance Use Cases

As regulatory expectations intensify, banks are pressured to manage and report risk data with greater transparency and reliability. BCBS 239, a framework from the Basel Committee on Banking Supervision, lays out 14 key principles for effective risk data aggregation and reporting. While the framework is well-known, its operationalization remains elusive for many institutions. This blog explores how modern data governance—powered by platforms like OvalEdge, can help banks translate BCBS 239 principles into action.

While most banks understand the importance of BCBS 239, translating principles into action remains a challenge. Legacy infrastructure, unclear ownership, and manual workflows continue to undermine reporting quality and audit readiness. This blog connects each BCBS 239 requirement to practical, governance-driven solutions.

What is BCBS 239?

BCBS 239 is a regulatory framework issued by the Basel Committee on Banking Supervision, titled “Principles for Effective Risk Data Aggregation and Risk Reporting.” It aims to improve the accuracy, completeness, timeliness, and adaptability of risk data within banks, especially large, systemically important financial institutions.

The 2008 financial crisis revealed that many banks lacked the infrastructure and governance needed to produce reliable risk reports during periods of stress. In response, BCBS 239 was published in 2013 to set a higher bar for data governance, data quality, and risk reporting capabilities.

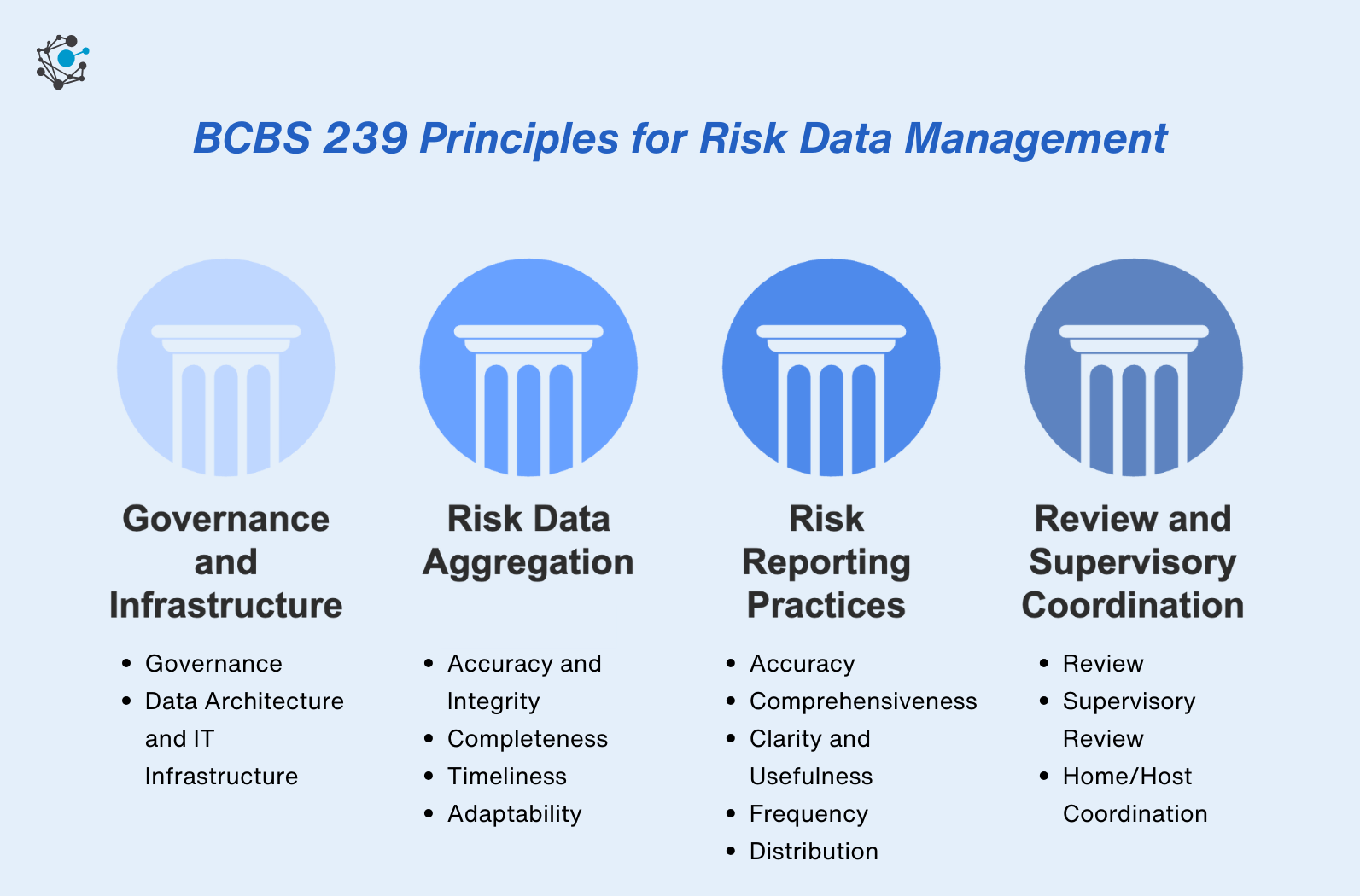

The framework outlines 14 high-level principles, grouped under four themes:

What are the 14 BCBS 239 Principles?

I. Governance and Infrastructure

1. Governance: Banks should have strong governance arrangements around risk data aggregation and risk reporting.

2. Data Architecture and IT Infrastructure: Robust architecture and infrastructure should support risk data aggregation capabilities and reporting practices.

II. Risk Data Aggregation Capabilities

3. Accuracy and Integrity: Risk data should be accurate and reliable.

4. Completeness: Risk data should capture all material risk exposures.

5. Timeliness: Aggregation of risk data and reporting should be timely.

6. Adaptability: Banks should be able to adapt their risk reporting to meet ad-hoc requests during a crisis or changing regulatory needs.

III. Risk Reporting Practices

7. Accuracy: Risk reports should accurately and precisely convey aggregated risk data.

8. Comprehensiveness: Reports should cover all material risks across the institution.

9. Clarity and Usefulness: Reports should be clear, concise, and tailored to the needs of the recipients.

10. Frequency: Reports should be produced with appropriate regularity.

11. Distribution: Reports should reach relevant stakeholders in a secure and prompt manner.

IV. Review and Supervisory Coordination

12. Review: Compliance with the principles should be reviewed regularly.

13. Supervisory Review: Supervisors should assess and enforce compliance.

14. Home/Host Coordination: Supervisory authorities should cooperate across jurisdictions to ensure consistent application of the principles.

Why BCBS 239 may seem challenging to implement

Despite its clarity on what good risk reporting should look like, BCBS 239 is notoriously hard to implement. Common hurdles for financial institutions include:

1. Legacy systems and data silos

Risk data is often distributed across outdated platforms, with different tools, formats, and owners. Without a unified view, banks struggle to ensure consistency or traceability.

2. Manual, spreadsheet-based reporting

In many institutions, critical risk reports are still compiled manually. This introduces human error, slows down review cycles, and limits auditability.

3. Lack of clear ownership

Many banks lack defined stewardship roles, making it difficult to assign responsibility for data quality, lineage, or certification.

4. Regional regulatory differences

For global banks, varying standards across jurisdictions make it hard to apply BCBS 239 uniformly, increasing the risk of non-compliance.

5. Limited lineage and change tracking

Auditors require visibility into where data comes from and how it's transformed. Without automated lineage and change logs, institutions rely on manual reconciliation and guesswork.

The role of data governance in enabling BCBS 239

BCBS 239 helps banks strengthen how they identify and manage risk. But meeting its requirements takes more than system upgrades or new reporting tools, it demands clear control over data across the organization.

That’s where data governance plays a critical role.

Data governance is defined how data is owned, managed, and trusted, ensuring it remains accurate, consistent, timely, and reliable, not just for risk, but across all business functions.

Governance practices like standardized taxonomies, defined ownership, data quality checks, audit trails, and lineage are essential for compliance. These elements provide a structured, scalable approach to managing data, shifting banks from siloed, manual workflows to governed, auditable, and reliable reporting.

Key data governance use cases mapped to BCBS 239 principles

The following use cases span five governance areas. Each aligns with specific BCBS 239 principles to support traceable, compliant reporting.

.png?width=736&height=552&name=Key%20data%20governance%20use%20cases%20mapped%20to%20BCBS%20239%20principles%20(1).png)

A. Data governance & ownership

A.1 Standardized risk data taxonomy and metadata registry

Establish and maintain a governed repository of risk definitions, critical data elements (CDEs), and business glossaries.

Solves: Inconsistent interpretations of key risk metrics across departments.

Mapped to:

-

Principle 1 – Governance

-

Principle 6 – Accuracy

-

Principle 7 – Adaptability

A.2 Role-based data stewardship and ownership

Define and assign ownership roles (owners, stewards, custodians) using RACI matrices and workflow tools.

Solves: Ambiguity in accountability across distributed data teams.

Mapped to:

-

Principle 1 – Governance

-

Principle 2 – Design

-

Principle 14 – Home/Host Coordination

A.3 Cross-jurisdictional governance alignment

Coordinate risk governance practices across regional regulatory environments.

Solves: Disparities in global reporting standards.

Mapped to:

-

Principle 14 – Home/Host Coordination

B. Data quality & monitoring

B.1 Data quality rules and sashboards for risk data

Implement rules to enforce completeness, accuracy, and timeliness. Visual dashboards help surface anomalies.

Solves: Hidden data issues that impact risk reporting.

Mapped to:

-

Principle 3 – Accuracy and Integrity

-

Principle 4 – Completeness

-

Principle 5 – Timeliness

Related Post: Top 8 Features of a Data Quality Tool

B.2 Automated data reconciliation across systems

Compare data across systems to catch mismatches and validate key metrics.

Solves: Data inconsistencies from fragmented systems.

Mapped to:

-

Principle 3 – Accuracy and Integrity

-

Principle 6 – Accuracy

-

Principle 8 – Comprehensiveness

B.3 Risk data validation for stress testing and scenarios

Validate data inputs for stress testing frameworks like ICAAP or CCAR.

Solves: Gaps in data readiness during crisis simulations.

Mapped to:

-

Principle 3 – Accuracy

-

Principle 5 – Timeliness

-

Principle 9 – Scenario Analysis

C. Lineage, traceability & transparency

C.1 End-to-end Data lineage for risk reports

Capture data flows from source systems to risk dashboards.

Solves: Audit traceability and explains reporting anomalies.

Mapped to:

-

Principle 3 – Accuracy

-

Principle 6 – Data Traceability

-

Principle 10 – Clarity

Related Post: Data Lineage | Drivers and Techniques

C.2 Scenario-based impact analysis

Run simulations to assess how changes affect downstream reporting.

Solves: Change management and report resilience.

Mapped to:

-

Principle 6 – Data Traceability

-

Principle 7 – Adaptability

-

Principle 10 – Report Clarity

D. Reporting, timeliness & adaptability

D. 1 Integrated reporting workflow and certification

Build review and approval workflows for reporting. Maintain golden-source datasets.

Solves: Delays and inconsistencies during report preparation.

Mapped to:

-

Principle 5 – Timeliness

-

Principle 8 – Comprehensiveness

-

Principle 11 – Coordination

D.2 Federated data governance at scale

Empower local control within a centralized policy framework.

Solves: Balancing compliance across global and local teams.

Mapped to:

-

Principle 1 – Governance

- Principle 2 – Design

- Principle 7 – Adaptability

D.3 Governance of structured and unstructured risk data

Extend governance beyond databases to documents and qualitative sources.

Solves: Oversight for operational and non-financial risks.

Mapped to:

-

Principle 3 – Accuracy

-

Principle 4 – Completeness

-

Principle 10 – Clarity

E. Audit readiness & data culture

E.1 Comprehensive audit trails and data change logs

Track who accessed, edited, or approved risk data and when.

Solves: Meeting audit demands with minimal disruption.

Mapped to:

-

Principle 6 – Traceability

-

Principle 10 – Auditability

-

Principle 13 – Review

Related Post: Data Governance & Data Stewardship Explained

E.2 Organization-wide data governance awareness

Deploy scorecards, training, and metrics to promote governance culture.

Solves: Low adoption and lack of accountability.

Mapped to:

-

Principle 1 – Governance

-

Principle 13 – Review and Audit

-

Principle 14 – Home/Host Coordination

Case studies: Real-world implementations of these use cases

While BCBS 239 specifically addresses risk data governance in financial institutions, the underlying requirements, such as standardized data definitions, end-to-end lineage, federated governance, and audit readiness, are not unique to banking. These are universal data challenges that other industries are actively solving.

OvalEdge has helped organizations across sectors build governance practices that mirror the capabilities outlined in the BCBS 239 principles. The following case studies demonstrate how these solutions are already being implemented in the real world.

Building a standardized risk Taxonomy

Bedrock, a prominent real estate firm, consolidated data from multiple systems into a single metadata repository. By standardizing business terms and definitions across teams, they eliminated confusion and created a shared foundation for governance, addressing the kind of consistency BCBS 239 demands for critical data elements (CDEs).

Establishing stewardship and accountability

Delta Community Credit Union tackled unclear ownership by defining RACI-aligned stewardship roles for all key data assets. With OvalEdge, they implemented workflows that clarified accountability, reduced data ambiguity, and laid the groundwork for responsible, traceable data use.

Governing across jurisdictions

A Saudi agency’s NDMO initiative required compliance across multiple public-sector entities. OvalEdge enabled the organization’s central data office to enforce unified standards while allowing flexibility for local implementation, closely resembling the home/host coordination model required in BCBS 239.

Automating data quality and monitoring

Gousto, a fast-scaling food tech company, adopted automated data quality rules and dashboards to proactively detect issues in operational and customer datasets. These mechanisms now serve as the first line of defense in ensuring data integrity—one of the core requirements of BCBS 239.

Achieving reconciliation and traceability

At Bedrock, multiple legacy and cloud systems created complexity in understanding how data moved across the enterprise. OvalEdge provided end-to-end lineage and system reconciliation, helping the teams answer “where did this number come from?”—a question BCBS 239 expects banks to answer confidently and consistently.

Scaling governance through federated models

In the highly regulated world of sports booking, a global operator implemented a data mesh architecture with OvalEdge to balance central control with domain-level autonomy. This federated governance approach enables agility while keeping policy enforcement intact—key for organizations operating across jurisdictions.

Managing structured and unstructured risk data

Upwork, a leading technology marketplace, needed to apply governance policies not just to databases, but also to sensitive documents and user-generated content. With OvalEdge, they extended lineage, access controls, and classifications to unstructured data, critical for regulatory coverage beyond tabular datasets.

Enabling audit readiness and cultural adoption

Returning to Delta Community Credit Union, their implementation also highlights the importance of organizational buy-in. Beyond tools and controls, OvalEdge helped foster a governance-first mindset by offering stewardship training, dashboards, and scorecards, ensuring long-term sustainability and audit preparedness.

These examples prove that the core building blocks of BCBS 239 compliance—clear ownership, standardized definitions, quality controls, traceability, and audit readiness—are not theoretical. They're already in motion. And with the right platform, banks can activate these capabilities too, without starting from scratch.

OvalEdge capabilities that enable BCBS 239 compliance

BCBS 239 is not just about having governance policies on paper—it’s about operational agility. Banks must be able to produce reliable risk reports quickly, even as risk indicators shift, models evolve, or regulatory definitions change. Most traditional governance tools aren’t built for that kind of adaptability. OvalEdge is.

At the heart of OvalEdge is a metadata-driven data catalog that acts as a single system of record for all risk-related data. It not only inventories and classifies data from across systems but also powers every aspect of governance, from ownership and quality monitoring to lineage and reporting traceability.

Learn more about our data catalog.

Why OvalEdge Is Different

While many governance platforms are designed for static structures and checklist-style compliance, OvalEdge is designed to evolve. It goes beyond passive metadata management by combining a data catalog with automation, workflow, and policy enforcement—creating a unified platform for real-time, governed risk reporting.

Its architecture and workflows allow banks to:

-

Introduce new risk indicators (e.g., operational or ESG risks) without re-engineering pipelines

-

Update business definitions or calculations while maintaining downstream integrity

-

Modify reporting structures without losing lineage, quality context, or auditability

This kind of adaptability is essential for meeting BCBS 239 principles like Adaptability (P6) and Review (P13), especially when reporting under pressure and in real-time.

Key Differentiators

-

Unified Data Catalog: Centralizes metadata, classifies risk data assets, and links terms to business processes and reports

-

Structured + Unstructured Lineage: Captures data movement across systems, spreadsheets, and unstructured sources

-

Risk-Centric Workflows: Automates certification, attestation, and stewardship for reporting pipelines

-

Automated Report Validation: Embeds data quality rules and approval flows within reporting frameworks

-

Federated Governance: Supports domain-level control with central policy oversight

-

Glossary-to-Report Linkage: Maintains semantic consistency from business definitions to CDEs and final reports

-

Built-In Auditability: Native logging, access history, and version tracking—designed for compliance from the ground up

OvalEdge connects people, policies, and risk data in a way that’s both dynamic and disciplined, enabling compliance that scales with the complexity of modern financial institutions.

OvalEdge capabilities mapped to BCBS 239 principles

OvalEdge maps directly to all 14 BCBS 239 principles across governance, infrastructure, reporting, and audit-readiness.

.png?width=740&height=555&name=OvalEdge%20capabilities%20mapped%20to%20BCBS%20239%20principles%20(1).png)

OvalEdge helps institutions move from fragmented compliance to proactive risk governance, connecting people, data, and policy through one centralized, responsive platform.

Learn more about our outcome-focused data governance tools

Conclusion

BCBS 239 sets a gold standard for risk data governance, but reaching that standard requires more than documentation. It takes a platform that enables real-time visibility, auditability, and flexibility across the enterprise.

OvalEdge empowers banks to not only comply with BCBS 239, but to operationalize it, ensuring that risk data is consistently governed, transparent, and adaptable, even in times of change.

Key takeaways:

- BCBS 239 requires banks to aggregate and report risk data with speed, accuracy, and traceability.

- Many institutions struggle with legacy systems, manual workflows, and unclear data ownership.

- OvalEdge addresses these challenges by delivering integrated governance, real-time lineage, automated certification, and audit-ready workflows—all mapped to the 14 BCBS principles.